The reliance of some Welsh farms on government support payments and non-farming income is laid bare in new income figures.

For upland cattle and sheep farms, the Basic Payment Scheme (BPS), other subsidies, diversified incomes, and miscellaneous income such as rents and wayleaves, contributed around 25% on average to their total income and 153% of profits in 2022/23.

And this was reflected in other systems too – income from these for the average hill sheep farm was £344/hectare (ha) compared to the £515/ha income generated from beef, sheep and crops.

Survey director Tony O’Regan said that with these levels of dependency it was difficult to see how many Welsh farms with limited options for changing farming enterprises and/or system can be profitable without relying on non-farming income and Welsh Government support payments.

Aberystwyth University conducted the 2022/23 survey across a random sample of 550 Welsh farms.

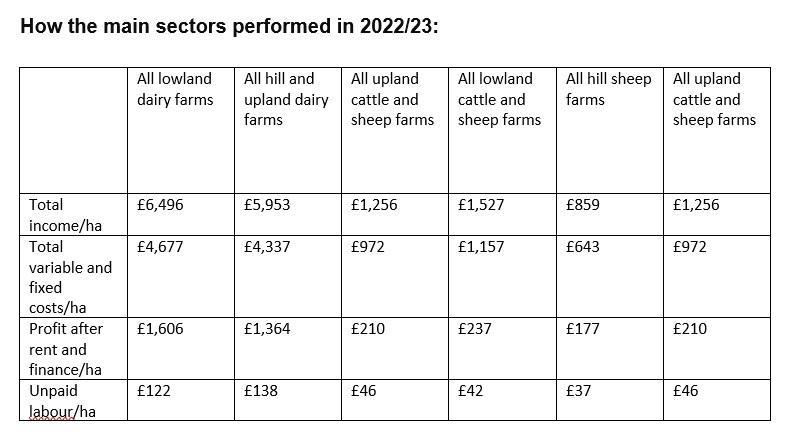

The data set out in the Farm Business Survey in Wales incomes booklet confirms significant differences between average performing farms and those in the top third for performance.

The top third lowland cattle and sheep farms made more than double the profit on each effective hectare compared to the average producer - £604/ha compared to £237/ha while on lowland dairy farms the top third made a net profit of £3,016/ha compared to the bottom third at £1,606.

For the top producers that equated to a net margin of 14p/litre more than the bottom third.

Meat producers showed similar variability with lamb production ranging from making 55p/kg to losing 114p/kg and, for suckler beef, from plus 62p/kg to minus 116p/kg.

“None of these take into account the farmer’s labour cost, the absence of which, if misused, presents a false picture of the economics of farm production,’’ said Mr Regan.

“The dairy sector best illustrates this since labour and pension costs alone can add over 10p/litre which then pushes the costs of production for the top third to 37p/litre and the bottom third closer to 47p/litre.’’

Finished cattle prices had remained buoyant for most of the season until forage shortages forced early sales for some. Cull and store cattle prices remained strong as did heifer prices.

But higher input prices in all sectors significantly impacted margins.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here